Northvolt, the Swedish battery manufacturer once valued at $12 billion and regarded as Europe’s strongest contender against Asian battery giants, has officially filed for bankruptcy. The company, which had previously sought Chapter 11 protection, declared bankruptcy on March 12, 2025, after failing to secure additional funding.

From Industry Pioneer to Financial Collapse

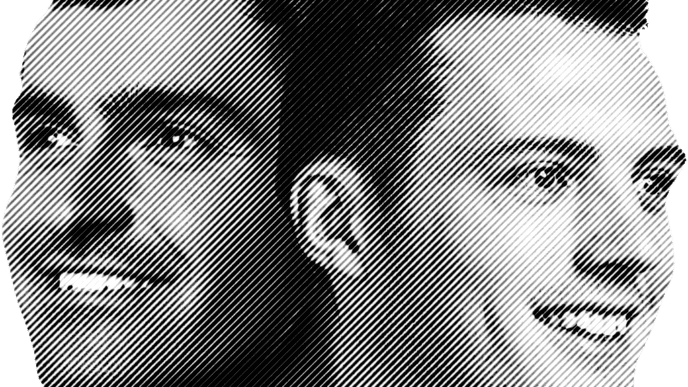

Founded in 2016 by former Tesla executives Peter Carlsson and Paolo Cerruti, Northvolt set out to revolutionize battery production and establish Europe as a leader in EV battery manufacturing. With over $15 billion in investments from major backers like Goldman Sachs, JPMorgan, Microsoft, and Volkswagen (which held a 21% stake), the company secured $50 billion in orders and operated a flagship gigafactory in Skellefteå, Sweden.

However, court filings from its initial bankruptcy declaration in November 2024 revealed a grim reality: Northvolt had amassed $5.8 billion in debt while its available cash dwindled to just $30 million—barely enough to sustain operations for a single week.

Operational Chaos and Manufacturing Inefficiencies

One of the most glaring signs of Northvolt’s mismanagement was the discovery of 4,000 unopened equipment boxes valued at €430 million, sitting unused across its facilities. This inefficiency, compounded by production running at only 5% of its total capacity, severely impacted output. By September 2024, Northvolt was producing only 60,000 battery units per week—far below its intended scale.

Workplace safety concerns further plagued the company, with multiple reported accidents, some fatal, delaying production. As a result, Northvolt lost a crucial €2 billion contract with BMW in mid-2024 after falling two years behind on deliveries.

Financial Struggles and Leadership Shakeups

Northvolt’s financial troubles stemmed from an unsustainable monthly burn rate of $100 million, while revenue from production remained insufficient to offset losses. In September 2024, the company laid off 1,600 employees (20% of its workforce) and paused expansion at its flagship facility. By October, it sought bankruptcy protection for one of its expansion units while scrambling to secure fresh funding.

Amidst these struggles, CEO and co-founder Peter Carlsson stepped down in November 2024, succeeded by CFO Pia Aaltonen-Forsell and former president of cells Matthias Arleth as COO. Despite these leadership changes, investors remained skeptical of Northvolt’s ability to recover.

Market Downturn and Strategic Missteps

Beyond internal failures, broader market challenges exacerbated Northvolt’s downfall. The European EV market faced slowed growth in 2024, partly due to tariffs on Chinese electric vehicles disrupting demand. Automakers subsequently scaled back their EV production targets, reducing the demand for Northvolt’s batteries.

Additionally, the company’s ambitious approach to vertical integration—controlling every aspect of battery production—proved unsustainable. Industry analysts suggested that incorporating second-life battery markets, where batteries are repurposed for energy storage after their EV lifespan, could have mitigated financial inefficiencies and enhanced supply chain resilience. However, Northvolt failed to adopt this strategy.

What’s Next for Northvolt’s Assets?

With bankruptcy proceedings underway, uncertainty looms over Northvolt’s global projects, particularly its planned $7 billion gigafactory in Montérégie, Quebec. Despite securing $7.3 billion in government support, Northvolt’s parent company collapse casts doubt on its viability. The Quebec government pledged $270 million, and a provincial pension fund added $200 million, but future funding remains uncertain.

A court-appointed trustee will now oversee the sale of Northvolt’s assets, including its Skellefteå factory and proprietary battery technology. Major investors, including Volkswagen and Goldman Sachs, have begun writing down their investments as the company’s valuation plummeted from $12 billion to zero.

As part of restructuring, Northvolt sold its remaining stake in battery recycling division Hydrovolt to Norsk Hydro for $6.79 million in January 2025. Even after securing $245 million in emergency financing, including $100 million from Scania, the company was unable to meet financial obligations, sealing its fate.

Lessons from Northvolt’s Collapse

Northvolt’s bankruptcy serves as a cautionary tale for the EV and cleantech industries. While technical innovation and government backing can fuel growth, operational mismanagement, high cash burn, and flawed strategic decisions can quickly erode a company’s foundations. As the industry pivots toward sustainability, Northvolt’s failure underscores the importance of balancing ambition with financial and operational discipline.

For more startp news, click here.